DAP and the Disbursement Acceleration Program: Philippine Economic Stimulus, Government Disbursement, and Why It Was Declared Unconstitutional

Public finance and constitutional law often intersect in ways that significantly influence national development, institutional stability, and the delivery of public services. The Disbursement Acceleration Program emerged as one of the most debated fiscal initiatives in recent Philippine history, not only because of its economic objectives but also because of the constitutional questions it raised. Introduced as a mechanism to stimulate government spending and address delays in fund utilization, the Disbursement Acceleration Program became central to discussions about executive authority, legislative control over appropriations, and the proper limits of economic stimulus policies.

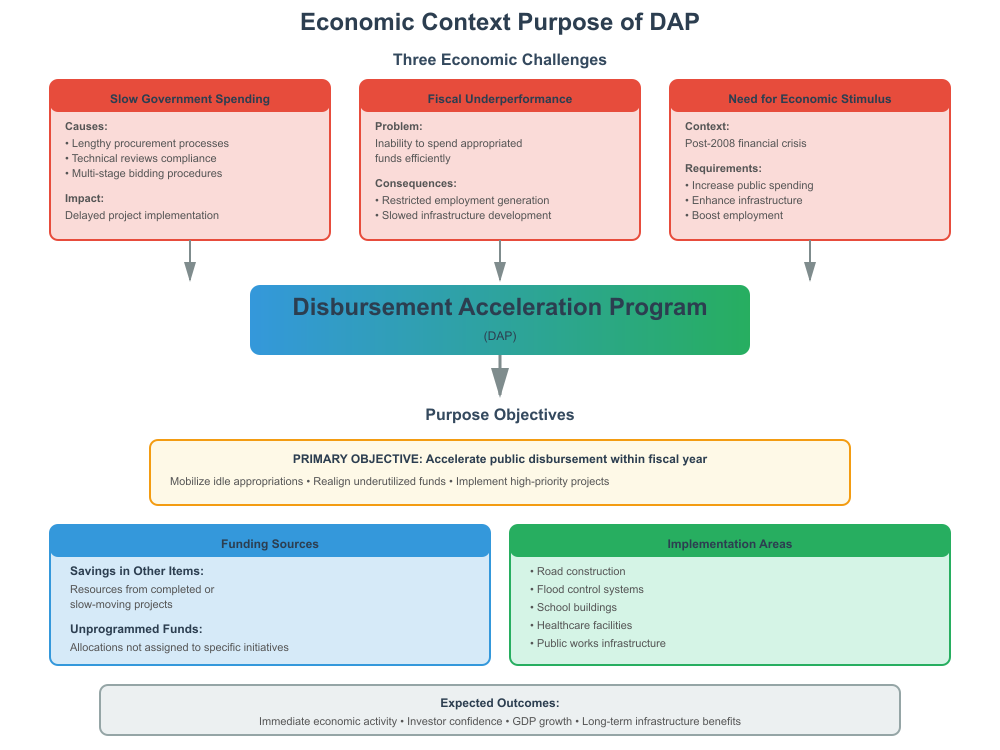

At its core, the Disbursement Acceleration Program was conceived as a strategy to accelerate the release and use of public funds within a given fiscal year. Policymakers argued that slow government disbursement hindered infrastructure development, reduced the multiplier effect of public investments, and constrained overall economic growth. Research institutions such as the Philippine Institute for Development Studies have long noted that underspending in government agencies can dampen gross domestic product expansion and delay development interventions. Within this context, the Disbursement Acceleration Program was presented as an economic stimulus measure intended to mobilize idle appropriations and redirect savings toward projects deemed capable of pushing economic growth.

The program operated within the broader framework of the Philippine national budget system, where Congress enacts the annual General Appropriations Act and the executive branch implements it. Tensions arose when certain mechanisms under the Disbursement Acceleration Program appeared to expand executive discretion in identifying savings, realigning funds, and funding projects not originally specified in the item in the General Appropriations. Critics questioned whether these actions were consistent with the constitutional principle that no appropriation shall be made except by law. Supporters, on the other hand, argued that the program was based on administrative flexibility permitted within budgetary processes and that it was implemented in good faith under extraordinary economic conditions.

These disputes culminated in petitions filed before the Supreme Court of the Philippines, which examined the constitutionality of the Disbursement Acceleration Program. In 2014, the Court issued a landmark decision declaring key aspects of the program unconstitutional. The Supreme Court ruling focused on several core issues, including cross-border transfers of funds, the definition and declaration of savings, and the funding of projects outside existing appropriations. While certain actions were invalidated, the Court also invoked the doctrine of operative fact to prevent undue disruption of completed projects and to recognize actions carried out prior to the decision.

The controversy surrounding the Disbursement Acceleration Program unfolded during a politically charged period that included the impeachment proceedings against Chief Justice Renato Corona. Public debate intensified as questions about accountability, transparency, and potential misuse of public funds gained national attention. Institutions such as the Commission on Audit and the National Bureau of Investigation were drawn into discussions concerning fund releases and oversight. The fiscal policy debate thus expanded into a broader examination of governance, separation of powers, and institutional checks and balances.

Beyond its legal dimensions, the Disbursement Acceleration Program provides a valuable case study in economic stimulus design and implementation. Economic stimulus policies aim to increase government spending during periods of underperformance in order to boost aggregate demand and stimulate domestic product expansion. However, the effectiveness and legitimacy of such programs depend not only on economic theory but also on strict adherence to constitutional and statutory limits. The Philippine experience demonstrates how the pursuit of accelerated public spending must be balanced against the foundational principle that budgetary authority rests primarily with the legislature.

This article offers a comprehensive exploration of the Disbursement Acceleration Program from historical, economic, legal, and governance perspectives. It examines the economic context that led to the program’s creation, the mechanisms used in its implementation, the reasoning behind the Supreme Court ruling that declared significant portions unconstitutional, and the broader implications for public finance management. By situating the Disbursement Acceleration Program within the intersection of fiscal policy and constitutional law, the discussion highlights how government spending initiatives can shape infrastructure development, institutional capacity, and public trust.

Historical Background of DAP as a Philippine Economic Stimulus Program

The Disbursement Acceleration Program emerged during a period when the Philippine government faced a critical challenge: while substantial funds had been approved under the national budget, actual government spending was consistently slow. This underutilization of funds affected infrastructure projects, social programs, and public works, which in turn dampened the country’s economic performance. Policymakers identified that despite stable revenue collection, delays in disbursement were limiting the government’s capacity to generate growth and provide timely public services. The Disbursement Acceleration Program was introduced as a corrective fiscal initiative aimed at accelerating the release of public funds and stimulating economic activity.

Economic analysts, including researchers from the Philippine Institute for Development Studies, highlighted that government spending is a critical driver of economic growth in developing countries. When public funds remain unutilized, projects are delayed, employment opportunities are lost, and the overall multiplier effect of government spending on gross domestic product is weakened. The Disbursement Acceleration Program was therefore conceived as a mechanism to bridge the gap between approved appropriations and actual expenditures, ensuring that allocated funds were mobilized for projects capable of delivering immediate economic impact.

The Economic Context Behind the Creation of DAP

Slow Government Spending

Slow government spending was one of the primary motivations for the creation of the Disbursement Acceleration Program. Bureaucratic procedures, such as lengthy procurement processes, technical reviews, and compliance with transparency safeguards, often delayed the release of funds. For instance, infrastructure projects under the Department of Public Works and Highways required extensive feasibility studies and multi-stage bidding processes before funds could be disbursed. While these measures were intended to prevent misuse of public resources, they inadvertently slowed project implementation.

The program sought to address this bottleneck by prioritizing projects that were ready for immediate execution. By reallocating idle or underutilized funds to projects that could be implemented quickly, the government aimed to generate economic activity and accelerate the benefits of public investment.

Fiscal Underperformance

Fiscal underperformance, in this context, referred not to insufficient revenue, but to the government’s inability to spend appropriated funds efficiently. When expenditures lag behind budgeted allocations, the expected stimulus effect of government spending diminishes. Analysts observed that delayed spending restricted employment generation, slowed infrastructure development, and reduced the overall contribution of public expenditure to domestic product growth.

The Disbursement Acceleration Program was designed to counteract this underperformance. By identifying unprogrammed funds or savings from completed projects and redirecting them toward projects with immediate execution potential, the program aimed to ensure that the government’s financial resources translated into measurable economic outcomes within the fiscal year.

Need for Economic Stimulus

The global economic climate also influenced the program’s creation. Following the 2008 financial crisis, governments worldwide implemented stimulus measures to maintain economic stability. Within the Philippine context, the Disbursement Acceleration Program was positioned as a domestic economic stimulus program intended to:

- Increase public spending in critical sectors

- Enhance infrastructure development

- Boost employment opportunities

- Support long-term productivity and competitiveness

Economic stimulus policies, such as DAP, operate on the principle that timely government expenditure can offset periods of underperformance or economic slowdown. In practice, the program aimed to channel funds to projects capable of producing immediate and tangible economic benefits.

Purpose and Objectives of the Disbursement Acceleration Program (DAP)

The primary objective of the Disbursement Acceleration Program was to accelerate public disbursement, ensuring that approved funds were actively used within the fiscal year. The program focused on mobilizing idle appropriations, including:

- Savings in other items: Resources from completed or slow-moving projects

- Unprogrammed funds: Allocations not previously assigned to specific initiatives

By realigning these funds, the government sought to implement high-priority projects, particularly in infrastructure and public works. Investments under the program included road construction, flood control, school buildings, and healthcare facilities. These projects were intended to stimulate immediate economic activity and create long-term benefits through improved infrastructure and service delivery.

The program also aimed to signal fiscal decisiveness. Demonstrating the government’s ability to accelerate spending was intended to reinforce investor confidence, promote domestic economic activity, and contribute positively to the country’s gross domestic product. In this way, DAP served both as a practical tool for project implementation and a policy instrument to support broader national development goals.

Legal Basis and Budget Framework Prior to the Supreme Court Ruling on DAP

The Disbursement Acceleration Program operated within the framework of the Philippine national budget system, which is guided by the Constitution. Congress enacts the General Appropriations Act each fiscal year, specifying how public funds are allocated, while the executive branch implements these allocations.

Supporters of DAP argued that the President had the authority to realign funds within the executive branch, particularly when savings or unprogrammed funds could be directed to projects that were ready for implementation. This interpretation of executive discretion emphasized administrative flexibility, efficiency, and responsiveness to economic conditions.

However, certain mechanisms employed under the program—such as cross-border fund transfers and funding projects not originally included in the appropriations—later became points of legal contention. Critics contended that these actions exceeded constitutional limits on appropriation authority, setting the stage for judicial review by the Supreme Court of the Philippines.

Structure, Implementation, and Key Actors in DAP

The Disbursement Acceleration Program (DAP) represented a complex policy initiative involving multiple government institutions, executive oversight, and intricate administrative processes. Its structure and implementation were designed to address the persistent challenge of slow government spending while maintaining compliance with existing budgetary mechanisms. Understanding how DAP funds were identified, realigned, and released provides insight into both the fiscal strategy of the program and the administrative controversies that ultimately surrounded it.

How DAP Funds Were Identified, Realigned, and Released

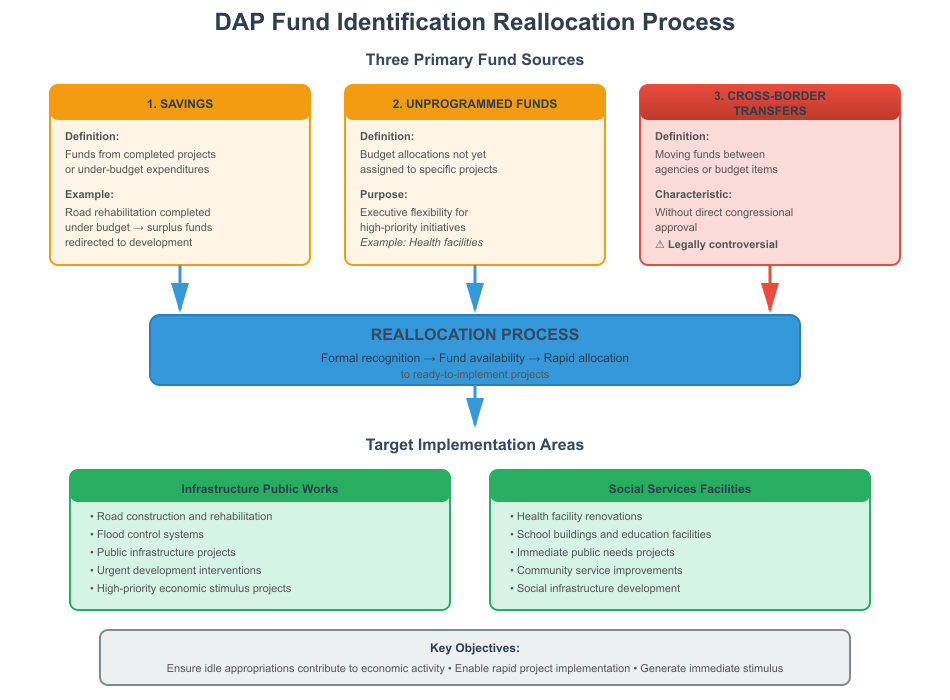

The Disbursement Acceleration Program relied on careful identification of existing resources within the national budget. Three primary categories of funds were utilized:

- Savings

Savings referred to funds from completed projects or items where expenditures were lower than initially allocated. For example, a road rehabilitation project that was completed under budget would generate savings that could then be redirected to other development interventions. These savings were formally recognized and made available for reallocation under DAP, ensuring that idle appropriations contributed to ongoing economic activity. - Unprogrammed Funds

Unprogrammed funds were allocations in the national budget that had not yet been assigned to specific projects. By design, these funds provided the executive branch with flexibility to fund high-priority initiatives requiring immediate disbursement. DAP allowed certain unprogrammed funds to be redirected toward ready-to-implement infrastructure, social services, and public works projects. For instance, health facilities requiring urgent renovation could be funded using such unprogrammed allocations to address immediate public needs. - Cross-Border Transfers

One of the most debated mechanisms in DAP was the practice of cross-border transfers, which involved moving funds between agencies or from one item in the national budget to another without direct congressional approval. These transfers allowed rapid allocation of resources to high-priority projects, including infrastructure and public works initiatives that were deemed urgent or capable of generating immediate economic stimulus. While this approach facilitated speedier implementation, it also became a focal point of legal scrutiny due to questions about the constitutional limits on the executive’s power to realign funds.

The Role of the Department of Budget and Management in Implementing DAP

The Department of Budget and Management (DBM) was the central administrative body responsible for executing DAP. Its functions included:

- Reviewing identified savings and unprogrammed funds

- Coordinating with line agencies for project readiness

- Monitoring compliance with spending guidelines

- Authorizing the release of DAP funds

The DBM worked closely with the Budget Secretary, who exercised authority to approve fund realignment and release, ensuring that allocations aligned with the overall objectives of the program. Administrative processes within DBM involved careful documentation of savings, justification of realignments, and prioritization of projects based on economic and social impact. These procedures were intended to provide transparency, maintain fiscal discipline, and optimize the use of government resources.

Budget Secretary’s Authority

The Budget Secretary played a critical role in implementing DAP. Empowered by executive prerogative and administrative rules, the secretary:

- Approved the identification of savings and unprogrammed funds

- Oversaw the prioritization of projects to receive DAP allocations

- Coordinated with agency heads to ensure that fund releases matched project timelines

- Ensured compliance with internal auditing standards to reduce risk of misuse

For example, under the DAP framework, the Budget Secretary could authorize the transfer of savings from a completed public works project to fund the construction of school buildings or health facilities, thereby accelerating the national disbursement process.

The Aquino Administration’s Justification of DAP as a Stimulus Measure

The Aquino administration framed DAP as a legitimate and necessary economic stimulus program designed to accelerate government spending, increase employment, and enhance national development. The administration’s justification rested on three main pillars:

- Policy Defense

The government argued that DAP was an administrative measure intended to optimize the utilization of approved appropriations. By reallocating savings and unprogrammed funds to projects that were ready for implementation, the administration maintained that the program strengthened economic growth without creating new expenditures outside the national budget. - Executive Reasoning

Executive officials, including the President and Budget Secretary, contended that slow government spending was limiting the multiplier effect of public investment. Through DAP, the government could target high-impact projects and expedite their implementation, ensuring that available resources translated into tangible benefits for infrastructure, social services, and public works. - Claimed Economic Benefits

The administration highlighted several outcomes associated with DAP, including:- Increased public spending within the fiscal year

- Acceleration of infrastructure development, such as road networks, flood control projects, and school buildings

- Job creation in construction, health services, and other sectors linked to government projects

- Contribution to gross domestic product growth by ensuring that public funds were actively utilized

For instance, allocations under DAP supported projects in both rural and urban communities, including renovation of provincial hospitals and public health facilities, demonstrating the program’s intended impact on national development and public service delivery.

The Supreme Court Ruling on DAP and Why It Was Declared Unconstitutional

The Disbursement Acceleration Program (DAP), initially implemented as a stimulus program designed to accelerate government spending and promote economic growth, eventually became the subject of intense legal scrutiny. Questions arose regarding whether the executive branch, under President Benigno Aquino III, exceeded its authority over public funds, particularly in relation to the appropriation power of Congress and the constitutional separation of powers. The resulting Supreme Court ruling clarified the limits of the executive’s fund realignment authority and the constitutionality of DAP projects and fund releases.

Key Constitutional Issues Raised Against DAP

- Appropriation Power of Congress

A central issue in the legal challenge to DAP was the Constitution’s clear provision that all public funds must be appropriated by law. Article VI, Section 29, empowers Congress to enact the General Appropriations Act, specifying how funds are allocated each fiscal year. Critics argued that the Aquino administration effectively bypassed Congress by using DAP to fund projects and initiatives not explicitly authorized in the national budget.

For instance, cross-border transfers and the use of unprogrammed funds allowed DAP allocations to support infrastructure projects and social services that were not included in the original General Appropriations Act. While these measures were intended to accelerate public works and other DAP projects, they raised concerns about the constitutionality of DAP and the executive’s adherence to legislative authority.

- Separation of Powers

The Supreme Court also emphasized the importance of separation of powers. Congress holds the exclusive power to appropriate funds, while the executive branch, including the Department of Budget and Management (DBM) and the Budget Secretary, is tasked with implementing these appropriations. DAP’s realignment of funds and transfers across agencies, which often bypassed congressional approval, was seen as an intrusion into legislative powers.

By authorizing cross-border transfers, the executive effectively determined the allocation of funds for public works and highways, health facilities, and other development interventions. Although intended to accelerate economic stimulus and promote national development, such actions challenged the constitutional balance between branches of government.

- Fund Realignment Authority

The program heavily relied on the executive’s interpretation of its authority to realign funds. This included:

- Savings from completed projects

- Unprogrammed funds in the national budget

- Transfers between agencies for ready-to-implement DAP projects

While the Aquino administration argued that these measures were necessary to push economic growth and efficiently utilize public funds, the Court questioned whether the President had the legal authority to fund projects outside the line items approved by Congress. The concern was that such realignment, if unchecked, could undermine legislative control over national budget allocations.

The Supreme Court Ruling: Provisions of DAP Declared Unconstitutional

In 2014, the Supreme Court, led by Chief Justice Renato Corona, declared several key provisions of the Disbursement Acceleration Program unconstitutional. The Court focused on three critical practices:

- Cross-Border Transfers

The movement of funds between agencies or budget items without congressional approval violated the Constitution. While these transfers facilitated the rapid implementation of DAP projects, they were ruled to have exceeded executive authority. - Creation of Savings

DAP allowed savings from completed projects to be redirected to new initiatives. The Court found that this practice, although intended to accelerate spending, effectively funded projects outside the scope of appropriations, undermining the General Appropriations Act and the appropriation power of Congress. - Funding Projects Outside Appropriations

Perhaps the most significant finding was that DAP fund releases supported projects not specified in the original national budget. These included infrastructure development under the Department of Public Works and Highways and other priority development assistance fund (PDAF)-type initiatives. The Court ruled this practice unconstitutional, emphasizing that all public spending must be explicitly authorized by law.

The Doctrine of Operative Fact and Its Application After the Supreme Court Ruling

To balance constitutional enforcement with practical governance, the Court applied the doctrine of operative fact. This doctrine protects acts performed in good faith under the DAP before the ruling, ensuring that completed projects and DAP releases were not undone, and public works continued without disruption.

- Protection of Completed Projects: Roads, hospitals, and health facilities funded under DAP allocations remained operational, reflecting the Court’s recognition of good faith in their favor.

- Legal Consequences: The ruling prohibited future cross-border transfers, realignment of unprogrammed funds outside approved allocations, and funding of projects not specified in the General Appropriations Act.

The decision clarified that while the Aquino administration implemented DAP as a stimulus program with intended economic benefits, any future realignments must strictly follow constitutional rules and legislative authorization.

Examples and Implications

- Infrastructure Projects: Renovation of provincial hospitals and construction of flood control systems funded under DAP were allowed to continue due to the doctrine of operative fact.

- Economic Stimulus: The program’s earlier releases demonstrated that timely public disbursement could generate measurable effects on gross domestic product and local employment.

- Legal Precedent: The ruling set a framework for ensuring that stimulus programs and DAP projects respect both the appropriation power of Congress and the principle of separation of powers.

Political Controversies and Public Accountability Issues Surrounding DAP

The Disbursement Acceleration Program (DAP) was not only a fiscal and economic initiative but also a lightning rod for political controversy and debates over public accountability. While the program aimed to accelerate government spending and stimulate economic growth, questions about its constitutionality, fund allocation, and oversight fueled public debate, congressional scrutiny, and calls for greater transparency. Understanding the controversies surrounding DAP provides insight into how public funds, DAP allocations, and executive discretion intersect with governance, accountability, and citizen trust in the Philippine context.

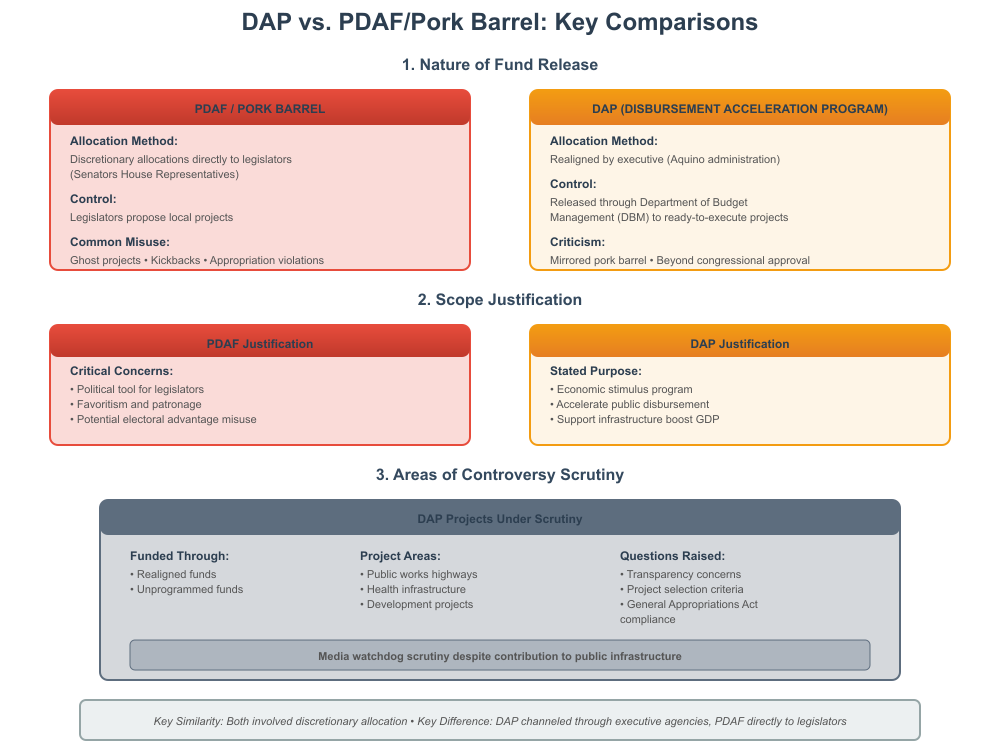

Comparisons Between DAP and Pork Barrel or PDAF Issues

A significant source of controversy surrounding DAP arose from comparisons to the Priority Development Assistance Fund (PDAF) or pork barrel system, which had been widely criticized for corruption and misuse. Both mechanisms involved the allocation of public funds for local development projects, but there were key distinctions:

- Nature of Fund Release

- PDAF/Pork Barrel: These funds were discretionary allocations provided directly to legislators, such as senators and members of the House of Representatives, who could propose local projects. Misuse of PDAF often involved ghost projects, kickbacks, or direct appropriation violations.

- DAP: Funds were realigned by the Aquino administration and released through executive agencies, particularly the Department of Budget and Management (DBM), to projects considered ready for immediate execution. While DAP did not directly channel funds to legislators, critics argued that certain DAP releases mirrored pork barrel mechanisms, enabling discretionary allocation beyond congressional approval.

- Scope and Justification

- DAP was justified as a stimulus program aimed at accelerating public disbursement, supporting infrastructure development, and boosting gross domestic product.

- PDAF was often criticized as a political tool, raising concerns about favoritism and potential misuse for electoral advantage.

- Examples of Controversy

- Several high-profile DAP projects, funded using realign funds and unprogrammed funds, were later scrutinized by media and watchdogs. While these projects contributed to public works and highways and health infrastructure, questions arose about transparency, selection criteria, and compliance with the General Appropriations Act.

Congressional Oversight, Commission on Audit Findings, and Public Debate

Congressional Oversight played a central role in investigating the implementation of DAP. Members of the legislature, including senators and House of Representatives committees, raised concerns over fund releases that appeared to bypass standard appropriation procedures.

- Commission on Audit (COA) Findings: The COA conducted audits on DAP allocations and reported instances of improper fund transfers, irregularities in documentation, and potential misuse of DAP funds. While many of the DAP-funded public works and social projects were completed in good faith, the COA highlighted the need for stricter adherence to budgetary rules and transparency measures.

- Public Debate: News outlets, advocacy groups, and civil society engaged in heated debates over the legality and ethical implications of DAP. Critics emphasized that cross-border transfers and funding of projects outside appropriations resembled the PDAF controversy, fueling public distrust. Defenders argued that the program was essential to accelerate government spending and deliver tangible economic stimulus, pointing to completed projects such as hospital renovations, flood control infrastructure, and educational facilities as evidence of positive impact.

- Political Figures: Senators such as Jinggoy Estrada and officials like Secretary Florencio Abad were scrutinized for their involvement or oversight in DAP fund releases. While some faced allegations of indirect benefit from DAP projects, investigations emphasized whether the Aquino administration acted within legal bounds and in good faith under the DAP.

Public Trust, Transparency, and the Broader Implications of the Supreme Court Ruling

The political controversies surrounding DAP highlighted the delicate balance between executive initiative, legislative authority, and public accountability. Several broader implications emerged:

- Transparency and Accountability in Government Spending

- The controversy underscored the need for clear reporting and auditing mechanisms for any stimulus program or DAP project. Public trust was eroded when fund allocation processes were opaque, and questions about discretionary use of funds persisted.

- Commission on Audit reports became vital tools for ensuring compliance, demonstrating the importance of independent oversight in maintaining fiscal responsibility.

- Reinforcing Constitutional Limits

- The Supreme Court ruling, declaring parts of DAP unconstitutional, reinforced that appropriation power of Congress is paramount. Executive agencies cannot unilaterally reallocate public funds without legislative authorization.

- This ruling clarified that while stimulus programs like DAP can promote economic growth, they must operate within legal and constitutional frameworks to ensure legitimacy and accountability.

- Implications for Future Public Finance Policies

- The DAP controversy influenced how future stimulus programs and realign funds would be structured, emphasizing compliance with the General Appropriations Act and the need for transparent DAP allocations.

- Public debate over pork barrel, PDAF, and DAP illustrated the political sensitivity surrounding discretionary fund releases and the necessity for structured, accountable spending programs to maintain citizen trust.

Examples

- Infrastructure projects such as school buildings, flood control systems, and provincial hospital renovations were often cited as successes of DAP, showing that accelerated public disbursement can deliver tangible benefits.

- However, public criticism focused on the perceived discretionary nature of DAP fund releases, drawing parallels with the PDAF scandal that had previously led to impeachment debates and high-profile investigations.

- The Aquino administration defended these releases as being in good faith under the DAP, designed to push economic stimulus and deliver value for public resources, highlighting the tension between efficiency and strict constitutional compliance.

Impact of DAP and the Supreme Court Ruling on Public Healthcare and Nursing Education

The Disbursement Acceleration Program (DAP), as a stimulus program designed to accelerate government spending, had significant implications for public healthcare and the broader education system, including nursing training institutions. While the program’s primary goal was to enhance economic growth through efficient use of public funds and realign funds to ready-to-implement projects, its design and the subsequent Supreme Court ruling declaring DAP unconstitutional had both practical and educational consequences. Understanding these impacts helps illuminate how fiscal policy, national budget allocations, and legal frameworks intersect with healthcare delivery and professional training.

How Government Disbursement Policies Affect Public Hospitals and Training Institutions

Government disbursement policies, such as DAP, directly influence the capacity and quality of public healthcare facilities. When funds are released efficiently:

- Infrastructure Development:

- Hospitals, provincial health centers, and training facilities can undergo renovations or expansions. For instance, DAP allocations funded upgrades in provincial hospitals, allowing nursing students and interns to train in improved clinical settings.

- Timely fund releases ensure that equipment procurement, laboratory renovations, and ward expansions are not delayed, positively affecting both patient care and educational experiences.

- Operational Capacity:

- Adequate disbursement allows public hospitals to hire necessary staff, including nurses, and to maintain essential supplies. Realignment of funds through programs like DAP can temporarily address shortages in operational budgets, facilitating better health service delivery and training opportunities.

- Program Sustainability:

- Policies ensuring proper fund management influence long-term healthcare operations. Programs implemented outside legislative approval, as highlighted in the DAP case, risk being suspended if declared DAP unconstitutional, potentially interrupting ongoing hospital projects and nursing education initiatives.

Example: Renovation of clinical simulation labs for nursing students may have been accelerated using realign funds under DAP. However, following the Supreme Court ruling, such projects had to be reviewed to ensure they complied with General Appropriations Act provisions and constitutional limits.

Potential Effects of Realigned Funds on Healthcare Infrastructure and Services

DAP fund releases had immediate effects on healthcare infrastructure and service delivery:

- Enhanced Facilities: Realignment of unprogrammed funds allowed faster construction of hospital wards, procurement of medical equipment, and repair of existing infrastructure, improving the learning environment for nursing students.

- Improved Access: Faster disbursement facilitated expansion of services in underserved areas, enabling community health programs, vaccination drives, and emergency care support, often staffed by nursing trainees.

- Temporary Stimulus vs. Long-Term Planning: While DAP accelerated public works and hospital upgrades, reliance on executive discretion for fund realignment posed sustainability risks. Projects that were implemented outside the original appropriations could face delays or legal challenges after the DAP ruling, affecting continuity of healthcare services and institutional training programs.

Example: A provincial hospital that received a DAP allocation for upgrading its pediatric ward benefited from immediate infrastructure improvements. However, further expansions had to await legislative approval due to DAP being declared unconstitutional, highlighting the tension between rapid fund deployment and constitutional compliance.

What the Supreme Court Ruling on DAP Teaches Nursing Students About Public Finance and Accountability

The Supreme Court ruling on DAP serves as a critical case study for understanding the intersection of public finance, government accountability, and professional practice, particularly for future healthcare professionals:

- Importance of Constitutional Compliance in Public Spending:

- Nursing students, while primarily focused on clinical care, can learn that public hospitals and training institutions rely on legally approved funding to operate. Executive initiatives like DAP demonstrate that even programs with positive intent must respect the appropriation power of Congress.

- Transparency and Oversight:

- Audits by the Commission on Audit (COA) and legislative review are essential to ensure that DAP allocations or similar funding programs are used efficiently and for their intended purpose. For healthcare, this reinforces the principle that accountability in fund releases safeguards patient care and educational resources.

- Good Faith Implementation vs. Legal Limits:

- The doctrine of operative fact, applied after DAP was declared unconstitutional, highlights that projects executed in good faith can continue while future initiatives require stricter compliance. Nursing students can appreciate that sound financial planning in public institutions must balance efficiency, ethical practice, and legal adherence.

- Lessons in Resource Management:

- Understanding how DAP realigned funds and funded healthcare infrastructure teaches nursing students about budget prioritization, fund allocation, and fiscal responsibility, principles directly relevant to hospital management and public health administration.

Example: Nursing administrators in public hospitals can draw lessons from DAP by ensuring that funds for clinical rotations, simulation labs, or hospital equipment are sourced through transparent, legally sanctioned channels, rather than relying solely on executive-driven stimulus programs.

Lessons for Nursing Students: Understanding Government Budgeting and Economic Stimulus

The Disbursement Acceleration Program (DAP) and the subsequent Supreme Court ruling declaring DAP unconstitutional provide critical lessons about the intersection of government budgeting, economic stimulus, and healthcare management. For nursing professionals, understanding how public funds are appropriated, disbursed, and monitored is essential—not only for hospital administration and clinical operations but also for appreciating the broader fiscal and legal environment that shapes public healthcare resources and nursing education.

Why Budget Appropriation and Disbursement Matter in Healthcare

Proper budget appropriation and disbursement are fundamental to the functionality of public hospitals, training institutions, and healthcare programs. The DAP experience illustrates several key points:

- Ensuring Operational Continuity:

- Timely disbursement of allocated funds affects staffing, procurement of medical supplies, and the maintenance of facilities. For instance, DAP allocations used for hospital renovations or equipment upgrades allowed for immediate improvements in patient care and nursing training environments.

- Delays in fund releases can hinder clinical rotations, compromise patient care, and limit access to development interventions necessary for practical learning experiences.

- Resource Allocation and Prioritization:

- Understanding the process of realign funds, savings, and unprogrammed funds teaches nursing administrators how to prioritize resources efficiently. Projects such as upgrading clinical simulation labs or expanding public health services require careful budgeting and legal compliance to maximize impact.

- The misuse or misallocation of funds—as seen in DAP controversies—demonstrates the consequences of circumventing constitutional appropriation rules, emphasizing the need for structured financial oversight in healthcare.

- Accountability and Transparency:

- Oversight mechanisms, including audits by the Commission on Audit (COA) and reporting to Congress, ensure that DAP fund releases or similar stimulus allocations are implemented in good faith and achieve intended outcomes.

- In healthcare, transparent budgeting safeguards public resources, supports ethical administration, and fosters trust among patients, staff, and students.

Example: A public hospital using DAP releases to upgrade a nursing simulation laboratory benefited from accelerated infrastructure development, but transparency and proper documentation were necessary to avoid allegations of misuse of DAP funds.

The Importance of Constitutional Limits in Economic Stimulus Programs

The Supreme Court ruling on DAP highlights that even well-intentioned stimulus programs must operate within constitutional limits:

- Respecting Legislative Authority:

- The appropriation power of Congress is non-negotiable. Executive agencies, including the Department of Budget and Management (DBM) and the Budget Secretary, can implement DAP allocations only within the scope of the General Appropriations Act.

- Projects funded outside approved appropriations, even if designed to push economic growth, are unconstitutional and may be halted, affecting hospital construction, renovation, or training programs.

- Balancing Efficiency and Legality:

- While rapid fund deployment accelerates public works and healthcare improvements, the legal framework ensures accountability. Nursing administrators can learn that efficiency must never compromise adherence to constitutional limits, which protect public trust and institutional integrity.

- Doctrine of Operative Fact:

- Completed projects executed in good faith are protected even after DAP was declared unconstitutional, demonstrating that compliance with legal principles can coexist with practical implementation of stimulus programs.

Example: Renovation of public health facilities funded under DAP allocations continued under the doctrine of operative fact, ensuring that nursing education and patient care were not disrupted despite the program’s constitutional challenges.

How Future National Budget Decisions May Affect Nursing Education and Clinical Training Opportunities

Government budget decisions directly influence nursing education, clinical training, and public healthcare services:

- Allocation of Realign Funds:

- Policies governing the realignment of funds, such as those attempted under DAP, determine whether hospitals can expand capacity, upgrade laboratories, or fund internships for nursing students.

- When executed legally, such stimulus programs can enhance training environments and improve development interventions for healthcare professionals.

- Healthcare Infrastructure Planning:

- Budgetary priorities, as defined in the national budget and the General Appropriations Act, affect construction of hospital wards, procurement of teaching equipment, and public health outreach programs. Nursing students rely on these investments for hands-on clinical experience and skill development.

- Impact of Fiscal Oversight:

- Oversight by Congress, Commission on Audit, and other regulatory bodies ensures that resources intended for healthcare and education are not diverted or misused. Proper oversight ensures that DAP or future stimulus programs provide measurable benefits for both patient care and nursing education.

Example: A regional hospital planning to expand its training facilities may depend on legally approved stimulus program allocations. Delays in fund disbursement due to legal or constitutional disputes, as seen with DAP, can postpone renovations, limit access to training equipment, and reduce available clinical rotations for students.

Conclusion

The Disbursement Acceleration Program (DAP) serves as a landmark case in Philippine public finance, illustrating the delicate balance between economic stimulus, efficient government spending, and adherence to constitutional limits. While the program was implemented under the Aquino administration to accelerate public disbursement, support infrastructure development, and promote economic growth, the Supreme Court ruling declaring DAP unconstitutional underscored that even well-intentioned programs must operate within the legal framework established by the General Appropriations Act and the appropriation power of Congress.

The DAP experience offers several key lessons:

- Legal Compliance is Paramount: Even projects with clear developmental benefits, such as hospital renovations, public health infrastructure, and educational facility upgrades, must respect constitutional limits and legislative authorization. The ruling highlighted that cross-border transfers, funding outside appropriations, and reallocation of unprogrammed funds cannot override the separation of powers.

- Transparency and Accountability Matter: The controversies surrounding DAP allocations, coupled with findings from the Commission on Audit, illustrate the importance of public accountability, proper documentation, and legislative oversight. These measures ensure that stimulus programs achieve their intended outcomes while maintaining public trust.

- Economic Stimulus Requires Structured Planning: Programs like DAP demonstrate that accelerating government spending can enhance national development and healthcare infrastructure, but careful planning, monitoring, and compliance with legal frameworks are essential to prevent misuse and political backlash.

- Lessons for Healthcare and Education: Nursing education, clinical training, and public hospital operations are directly affected by national budget decisions. DAP’s implementation and the subsequent court ruling reinforce that realigned funds, stimulus program allocations, and infrastructure investments must be legally sanctioned to ensure continuity in healthcare delivery and educational opportunities.

In essence, the Disbursement Acceleration Program highlights the intersection of fiscal policy, constitutional governance, and public service delivery. For nursing professionals and administrators, it provides a practical example of how public finance decisions influence healthcare operations, training environments, and overall system efficiency. The case of DAP emphasizes that achieving developmental and economic objectives requires not only strategic fund allocation and disbursement but also rigorous compliance with legal and ethical standards, ensuring sustainable progress in both national development and healthcare excellence.

Frequently Asked Questions

What is the Disbursement Acceleration Program?

The Disbursement Acceleration Program (DAP) was a stimulus program implemented by the Aquino administration to accelerate government spending and support public works, infrastructure development, and economic growth. It allowed the executive branch to realign unprogrammed funds and savings from completed projects to ready-to-implement initiatives.

Is DAP constitutional?

No. In 2014, the Supreme Court declared DAP unconstitutional because certain fund realignments and cross-border transfers bypassed the appropriation power of Congress and violated the separation of powers, although completed projects implemented in good faith were protected under the doctrine of operative fact.

What are DAP rights?

DAP itself is not a legal entity or person, so it does not have rights in the traditional sense. However, the “rights under DAP” can refer to the benefits or funding provided to agencies, local government units, and projects that received DAP allocations in good faith prior to the Supreme Court ruling.

Is DAP a government agency?

No. DAP is not a government agency. It is a government program managed by the Department of Budget and Management (DBM) and overseen by the Budget Secretary and the executive branch for the purpose of accelerating public disbursement and implementing stimulus projects.